Approach // Today

Today.

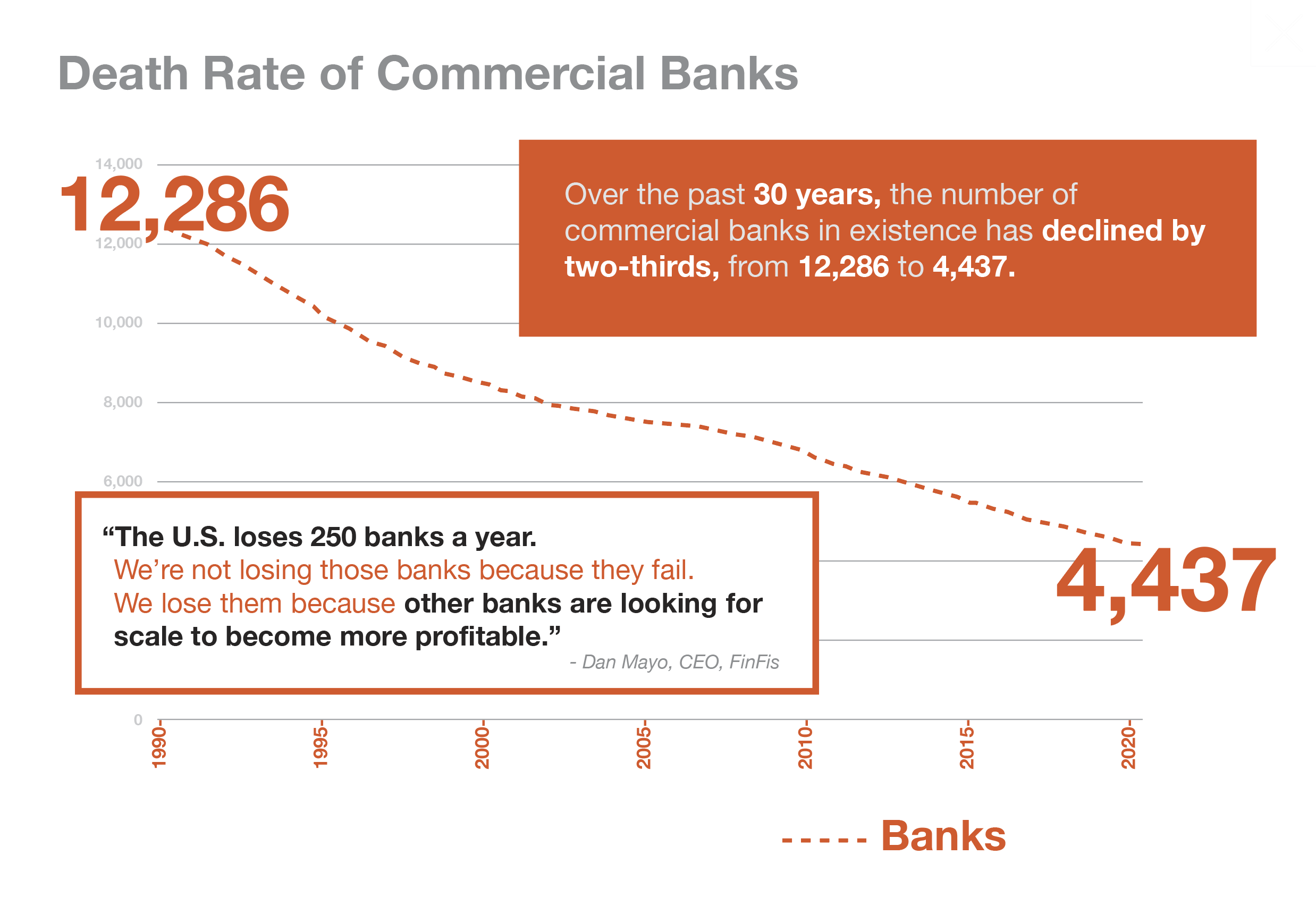

It’s hard to keep up. But community and regional banks can’t afford to wait until it’s convenient to be forward-thinking and strategic.

Approach // The Challenge

The Challenge.

Approach // The Good News

The Good News.

Approach // The Big Idea

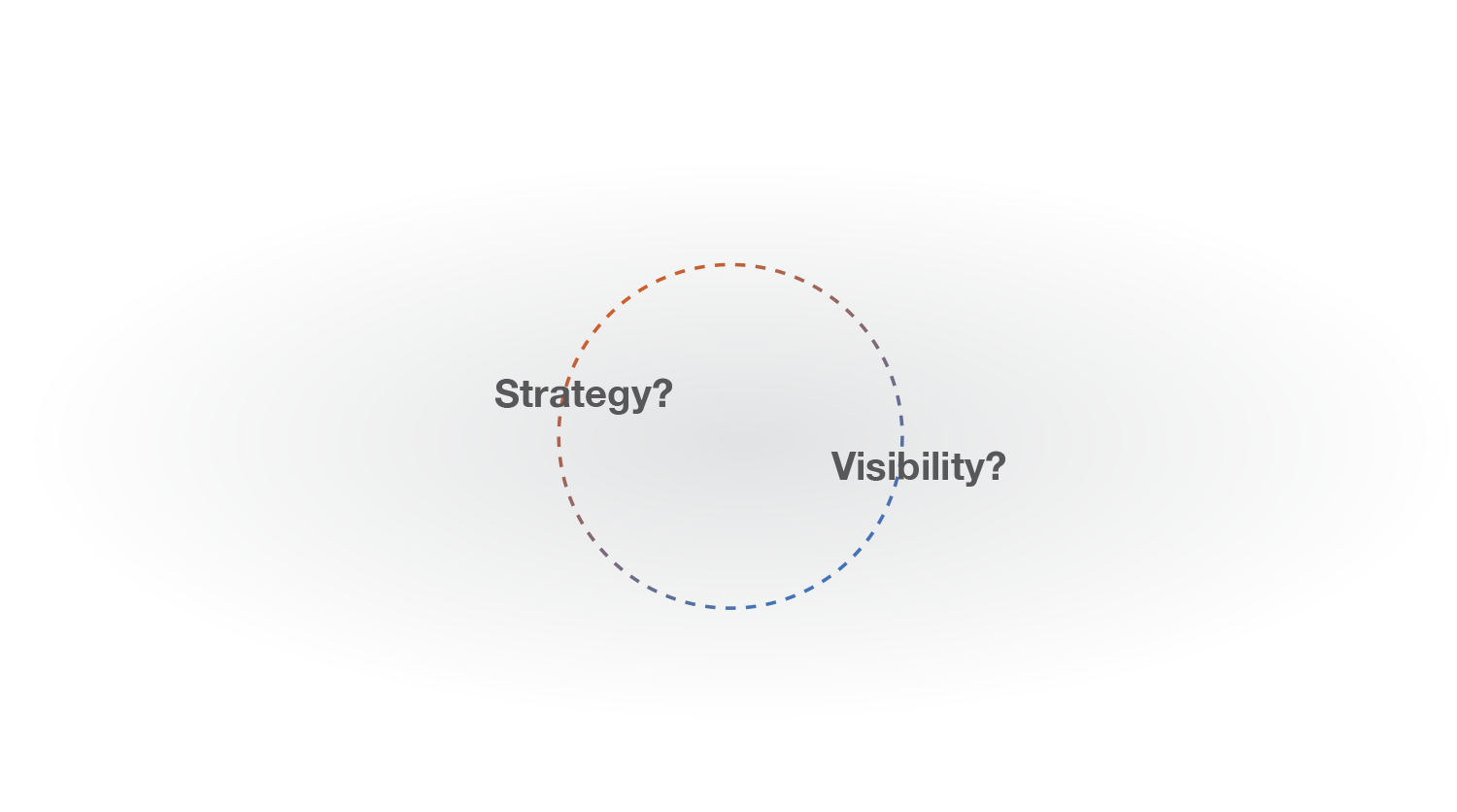

Risk.

Unified.

2. Risk quantification

3. Unified with Strategic Visibility for risk-return optimization.

Prospectively manage risk in the loan portfolio by gaining forward-looking visibility into incremental changes in credit quality and migration of credit risk. Leverage advanced credit risk analytics to calculate an allowance that accurately reflects the level of risk in the portfolio and complies with the latest accounting standards.

Execute your Strategic Plan with a 3 Lines of Defense risk management program including risk appetite, top risks, + key risk indicators covering key governance, credit, operations, market and technology risk.

Simulate prospective economic scenarios through rapid stress testing and see the potential impact on capital and financial performance while gaining visibility to the organization’s risk profile.

While data is appropriately comprehensive, the real benefit is that it is true - one version of the truth - and consistent. You can see much further because your outlook + forecasting are driven by a common data language and key indicators that are shared and goal-oriented.

With crystal-clear strategic visibility, FRU empowers you to navigate risks, identify key growth opportunities, and achieve your goals + objectives.

Financial Reporting

Budgeting and Forecasting

Loan & Deposit Reporting

Profitability Analysis

Strategic Planning

Capital Management & Allocation

Liquidity Management

Enterprise Risk Management

Risk Appetite & Key Risk Indicators

Enterprise-wide Stress Testing

Risk & Control Inventories

Compliance Management Program

Internal Audit Program

Technology Risk Governance Program

Credit Risk Management

Expected Loss Scorecards

CECL

Stress Testing & Analytics

Comprehensive & intuitive software solution

Preconfigured with leading methodologies yet, fully customizable

Secure Cloud or On-Premises Deployment

Mobile Dashboards

Automation & Scalability

Rapid Implementations

Optimize Risk-adjusted Returns

Financial Reporting

Budgeting and Forecasting

Loan & Deposit Reporting

Profitability Analysis

Strategic Planning

Capital Management & Allocation

Liquidity Management

Enterprise Risk Management

Risk Appetite & Key Risk Indicators

Enterprise-wide Stress Testing

Risk & Control Inventories

Compliance Management Program

Internal Audit Program

Technology Risk Governance Program

Credit Risk Management

Expected Loss Scorecards

CECL

Stress Testing & Analytics

Comprehensive & intuitive software solution

Preconfigured with leading methodologies yet, fully customizable

Secure Cloud or On-Premises Deployment

Mobile Dashboards

Automation & Scalability

Rapid Implementations

Optimize Risk-adjusted Returns

Videos

Case Studies

CLIENT

Publicly traded regional bank serving rapidly growing metropolitan area in the south and southwest regions of the U.S. The bank’s expansion strategy included the integration of previously failed community banks.

SITUATION

Having been formed through the acquisition of previously failed banks that had multiple credit strategies and cultures, there was a need for a holistic comprehensive credit risk management program which would enable the expected growth strategies while continuous providing full visibility to the entire credit portfolio. Management wanted to ensure consistency and accuracy of credit ratings while implementing aggressive regionally specific credit growth strategies. Visibility was crucial to make adjustments to these growth strategies based on potential environmental economic fluctuations. The bank’s strategy was to grow to $10 billion in 5 years.

SOLUTION

OnPoint initially focused on Credit Risk Management, delivering a Dual Credit Risk Rating program, Enhanced Allowance of Credit Losses, and Credit Risk Stress-testing. OnPoint then provided enhancement of Risk Management overall, which included:

- Development and implementation of comprehensive ERM

- Internal Audit program

- Compliance program

- Operational Risk Management Framework

- Mortgage Banking Risk Management program

RESULT

With the implementation of OnPoint’s 3 lines of Defense, the Bank now has a framework that allows front-line Process Owners, Independent Risk Management and Independent Risk Assessment to provide visibility on all necessary financial risk categories.

The insight and control provided by these programs has transformed their risk culture and now provides risk insight on a continuous basis, empowering risk-adjusted targeted growth and profitability.

CLIENT

A privately held regional community bank which doubled its size after a merger growing to $7 billion had expanded its footprint from a smaller rural concentration, to more high-growth mid-sized community market areas.

SITUATION

An OnPoint existing client requested additional support given their increased size and expansion of their business strategies, more complexity and regulatory expectations for management of risk. Specifically, the bank was seeking greater visibility from both a financial and a risk perspective with particular focus on enhancing the financial, enterprise, compliance, internal audit and credit risk management programs.

The acquisition raised the bar for financial, risk, regulatory reporting and monitoring expectations, given the complexity and breadth of the combined entities. Management’s strategy required visibility of key financial, risk, budgeting and performance metrics, as well as loan and deposit performance metrics. Further, a consolidated view of the financial and risk data was critical to strategic and forward-looking operational decisions.

SOLUTION

The bank selected a unified platform for all financial and key risk information streams – financial, credit, operational and capital.

Sola Analytics implementation of comprehensive budgeting and financial reporting enabled through an integrated and automated technology platform, and OnPoint’s implementation of enhanced ERM, Internal Audit, Compliance and Credit risk management programs provide the client with a unified view to ensure strategic visibility and success.

Features included:

- A consolidated risk tool set that includes credit risk and enterprise-wide stress testing based on prospective economic scenarios

- Visibility to the potential impact on capital and financial performance in addition to the organization’s risk profile

- Visibility to the potential impact on charge-offs and the provision for loan losses while identifying higher risk profile segments of the loan portfolio

RESULT

With the implementation of the FRU platform, the bank now has the right information in real-time to make risk-based decisions to their credit portfolio, financial forecasts, and overall strategic objectives. The management team at all levels can see the real-time impact of their decisions from a financial and risk perspective to take full advantage of opportunities across their newly acquired and diverse market segments.

CLIENT

Privately owned emerging regional bank with significant rural market presence as well as emerging presence in a high growth urban market.

SITUATION

After experiencing the impacts of the 2008 Financial Crisis, the Bank, then at $2B in assets, needed a better way to assess and monitor their credit risks in this new environment of high competition and global economic stresses. The Bank is focused on maintaining their localized community focused business model which drives their highly profitable results. Thus, the Bank recognized that their growth objectives and planned market segment expansion strategies require greater visibility to their risk exposure.

SOLUTION

OnPoint engagement began with our unique INREVAS process which provided the Bank’s leadership team with a risk adjusted assessment of their current state of risk management processes across the enterprise along with a roadmap of risk management process improvement opportunities that would increase stakeholder value. A series of projects followed, that focus on both credit risk management enhancements as well as ERM implementation:

- Dual Credit Risk Rating

- Allowance for Credit Losses

- Enterprise Risk Management Program Complete (governance, process level risk & control ratings from the front line)

- Internal Audit Program integrated to ERM

- Compliance Program integrated to ERM

RESULT

Our Client, now closing in on $7B in assets, is well poised to better anticipate changes in a fluctuating marketplace. They have already managed similar hurdles that have caused stresses under their previous risk programs. They have reported that they are now able to focus extra resources and energy toward growth and expansion.

CLIENT

A publicly traded bank holding company with $8 billion in assets operating three entities: a regional bank, a national mortgage company and a local investments firm.

SITUATION

The holding company’s entities all operated independently. Facing unique strategic plans and risk environments, each needed Enhanced Risk Management programs that could integrate and translate effectively to the enterprise. Each had specific growth opportunities, timelines, financial objectives, regulatory oversight needs and business cultures. In addition, because of significant regulatory constraints, they were unable to move forward with their plans for growth. There was a clear need for an enterprise-wide visibility to risk, and alignment of risk appetite.

It became imperative that risk vocabulary, rating and risk-adjusted decision-making was also needed. Changing this risk culture would be the only way forward to enable their growth strategy and expand opportunities.

SOLUTION

OnPoint developed a program enhancement plan providing a road map and guide for the implementation of Enterprise Risk Management across all entities aligned to the three lines of defense framework. The engagement included the following:

- Review and implementation of the eGRC System

- Focused delivery of integrated Technology Governance and Risk Management

- A comprehensive Credit Risk Management program with a Dual Credit Risk Rating program and a Credit Stress-testing program

- Integration of Enterprise Compliance Risk Management including eGRC integration

- Comprehensive internal audit program including eGRC integration

RESULT

As a result of these Risk Management enhancements, the organization had received the necessary go-ahead from the regulators to grow – both organically, and through acquisition – to $13 billion in assets while enhancing risk-adjusted returns within each entity. They are now able to see, review and discuss risk profiles and return tradeoffs between business activities, entities and strategies.

CLIENT

Privately owned 40-year-old regional community bank with $2 billion in assets. This Bank has dominated its local market presence, providing local banking to their communities.

SITUATION

After facing a significant amount of credit losses and impacts to capital, the Bank shifted senior management leadership and successfully focused on cleaning up its significant credit problem assets. Wanting to chart a new culture to grow through acquisitions and organic growth, the Bank was seeking assistance on how to improve their Credit Risk Management while maintaining their local community banking culture and avoid repeating the errors that caused the losses.

As their market growth was expanding into the more competitive urban areas, the Bank’s leadership team needed better risk information intelligence to select business opportunities that provide the best fit for mutual success.

SOLUTION

OnPoint initially focused on Credit Risk Management, delivering a Dual Credit Risk Rating program, Enhanced Allowance of Credit Losses, and Credit Risk Stress-testing. OnPoint then provided enhancement of Risk Management overall, which included:

- Development and implementation of comprehensive ERM

- Internal Audit program

- Compliance program

- Operational Risk Management Framework

- Mortgage Banking Risk Management program

RESULT

With the implementation of OnPoint’s 3 lines of Defense, the Bank now has a framework that allows front-line Process Owners, Independent Risk Management and Independent Risk Assessment to provide visibility on all necessary financial risk categories.

The insight and control provided by these programs has transformed their risk culture and now provides risk insight on a continuous basis, empowering risk-adjusted targeted growth and profitability.

CLIENT

A publicly traded regional super-community bank with $12 billion in assets has experienced significant growth through acquisition and expansion into the Southeast U.S.

SITUATION

Having focused on the production side for growth, the bank faced regulatory pressure to enhance their risk management strategy, governance and visibility to their expanded environments. The bank’s existing risk structure and reporting confirmed that risk measurements were area-specific, and aggregated risk decisions were fragmented, complex and inconsistent. The risk management group was not including the first line of defense process owners to provide their risk environment view. The bank needed an enterprise risk management program to ensure that all risks are included, and that the assessment process was executed reliably and continuously. The Bank had previously invested in risk technology but was unable to leverage it to provide a clear view of their risk environment no matter where the activities occurred.

SOLUTION

OnPoint conducted an initial assessment of the environment and then developed an Enterprise Risk Management Program Strategic Plan, and the resulting delivery included:

- A focused Enterprise Risk Management Program aligned to the 3 Lines of Defense

- A comprehensive enterprise-wide first line of defense risk and control self-assessment which produced the organization’s first ever enterprise view risk reporting.

- A review and integration to the eGRC system to include all 3 Lines of Defense

- Support for regulatory orientation of the risk program implementation

RESULT

With the implementation of OnPoint’s Enterprise Risk Management Program, the Bank-wide view of the risk environment enabled the bank to satisfy the regulatory concerns necessary to enable the bank to continue its expansion strategies. The ERM governance and reporting framework ensured that front-line Process Owners’ assessment (1st line of defense) was established and that the Risk group could provide the executive and board with true risk visibility across their expanding markets.

CLIENT

A privately held community bank, $2.5 billion had recently converted from a credit union to a national bank charter. Their strategic plan included key initiatives for advanced commercial lending and serving rapidly growing metropolitan area with strong community ties.

SITUATION

With the transition from a credit union to a commercial bank, there was a compelling need for the organization to change their focus from controls-based risk management processes to strategic risk management program to support the plans for growth. The bank’s strategic plan included significant expansion in products as well as growing their commercial lending into new high-growth industries. The bank needed a comprehensive risk management program that could bring the three lines of defense together under an scalable enterprise framework which would enable the organization to grow with clear visibility to the risks involved.

SOLUTION

OnPoint engagement began with our proprietary risk management program maturity assessment (INREVAS) process which provided the Bank’s leadership team with an objective view of the maturity and current state of risk management processes across the enterprise. This assessment allowed for the development of a comprehensive roadmap of risk management process improvement opportunities that would increase stakeholder value.

OnPoint then focused on an enhanced Enterprise Risk Management program implementation which included:

- Development and implementation of comprehensive 3 Lines of Defense ERM program

- Selection and Implementation of an eGRC system to support the ERM program

- Internal Audit & Compliance integration within ERM program

RESULT

The Bank has since gone public and through strategic acquisition of other banks, is now at the $7 billion mark with one of the best efficiency and returns ratios within their peer group.

With the implementation of OnPoint’s ERM program, the Bank has a framework that provides visibility and consistent risk ratings across all risk categories. The eGRC system provides the comprehensive reporting of risk enabling the Bank to align their risk appetite with their unique growth opportunities and strategic objectives.

Delivering Strategic Visibility.

We get you out of react-mode and back to your strategic role by delivering forward-looking financial and risk management solutions to help you realize your growth objectives with greater visibility, efficiency and resilience.

We get you out of react-mode and back to your strategic role by delivering forward-looking financial and risk management solutions to help you realize your growth objectives with greater visibility, efficiency and resilience.

Finance.™

Risk.

Unified.

Submit the form on the right and we’ll provide you with a link to a brief summary of our Rapid Loan Portfolio Stress Test for 2022-2023.

You will also receive a link to our latest eBook, 7 Key Elements Needed to Integrate your Financial and Risk Strategy and Why They’re Essential.

And if you want to jump right in, we invite you to call us at 713-515-1285 or email us at [email protected]

Contact Us

to set up a demonstration and consultation.